Today, Starbucks China Announces a Major Move: Starting June 10, Three Flagship Categories—Frappuccino, Shaken Tea, and Teavana Tea Latte—will See Price Cuts for Dozens of Products, with an Average Price Reduction of About 5 Yuan for Grande Sizes.

Additionally, in terms of product innovation, on June 17, Starbucks China will collaborate with Disney’s “Zootopia” IP to launch three new co-branded Shaken Teas. Besides Shaken Teas, Teavana Tea Lattes will also introduce more new flavors.

Starbucks China stated that this move aims to strengthen its non-coffee beverage market and create an all-day service scenario of “coffee in the morning, non-coffee in the afternoon.”

“Starbucks is becoming more down-to-earth,” said Zhu Danpeng, a food industry analyst in China, in an interview with the Shanghai Securities News. He analyzed that the price reduction and expansion of non-coffee products can better meet the diverse needs of customers, achieve a broader consumer base, and thus help address issues related to store revenue, profit margins, and market share.

Non-coffee Products Lower Prices to Target the “Afternoon Tea” Scene

Starting tomorrow, consumers will be able to purchase non-coffee products at more affordable prices in Starbucks stores.

According to the announcement made by Starbucks China today, dozens of products across its three flagship non-coffee categories—Frappuccino, Shaken Tea, and Teavana Tea Latte—will collectively introduce a new summer “heart-thumping price” starting June 10.

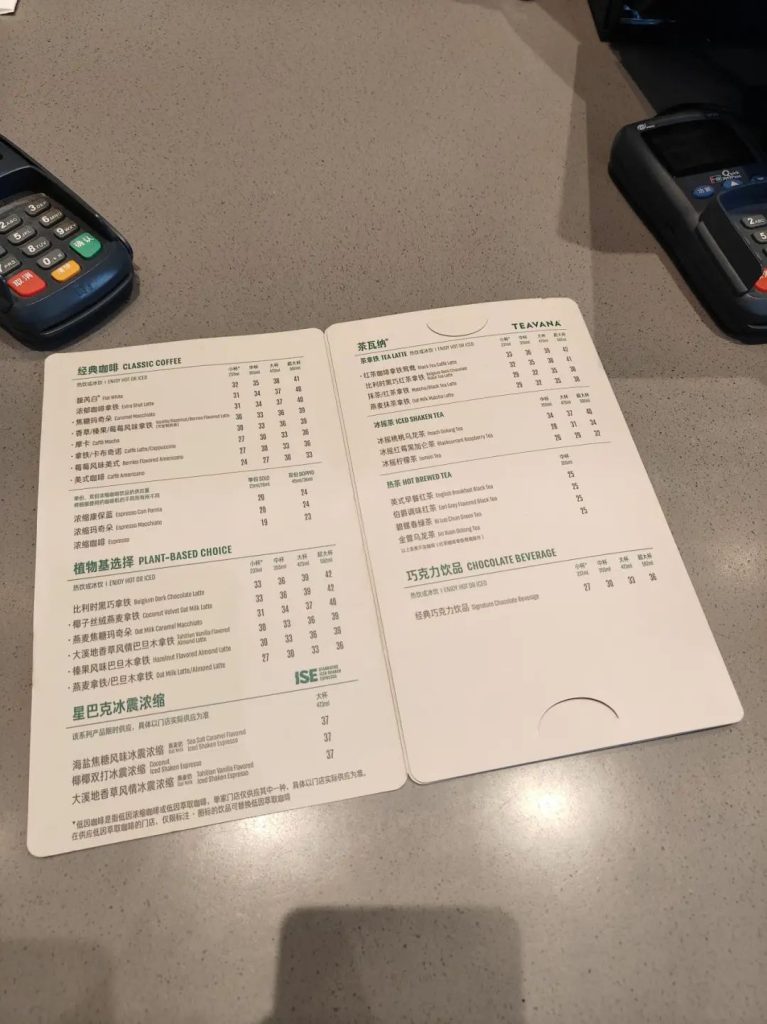

It is reported that the price reduction for this round of beverages ranges from 2 to 6 yuan. For Grande sizes, the average price cut reaches 5 yuan. After this round of price adjustment, the lowest price for a single cup will be only 23 yuan.

On June 9, a reporter noticed in a Starbucks store in Shanghai that the prices for non-coffee drinks in Grande and Tall sizes were concentrated between 30 and 40 yuan, with a few products priced below 30 yuan. For example, the price for a Tall Shaken Lemon Tea was 26 yuan, and for a Grande size, it was 29 yuan.

“Starting tomorrow, the price of Shaken Lemon Tea will be reduced by 3 yuan,” a store employee told the reporter.

Behind the price reduction of non-coffee products, Starbucks China aims to tap into the “afternoon tea” market. In recent years, the emerging beverage consumption model of “morning coffee + afternoon non-coffee” has gradually become the mainstream in the market. Leading coffee companies, such as Luckin Coffee, are also increasing their efforts in the “non-coffee” scene by launching light milk tea and other products to capture the vast “afternoon tea” market.

However, unlike the 9.9 yuan light milk tea launched by Luckin, Starbucks’ focus on non-coffee products is not intended to join the new tea drink track.

“These three series are products that Starbucks has had before, and their pricing and positioning are fundamentally different from new tea drinks. Our main consideration is to provide more choices for customers who come into the store, so that they will think of Starbucks not only when drinking coffee but also when choosing non-coffee products,” said a relevant person in charge of Starbucks China to the reporter.

Currently, the “price war” in China’s coffee market is still ongoing. Why did Starbucks China choose to lower the prices of non-coffee products instead of coffee products? Regarding this question, Zhu Danpeng believes that it is related to Starbucks’ positioning.

“The main reason for the high price of Starbucks is that it has both product attributes and emotional attributes, such as its third space and brand tone. Starbucks’ coffee products will not easily lower prices because once they do, the brand tone will be lost. However, lowering the prices of non-coffee products can attract more non-coffee consumers. In other words, coffee focuses on quality and price ratio, while non-coffee focuses on cost-effectiveness,” said Zhu Danpeng.

Revitalizing Growth Requires a Deeper Understanding of China

At the end of the 20th century, Starbucks entered the Chinese market with the strategy of “in China, for China” and has since held the position of “big brother” for over twenty years.

But in recent years, with the strong rise of local coffee brands such as Luckin and Manner, Starbucks’ performance in the Chinese market has also faced challenges.

According to Starbucks’ financial report for the fourth quarter of the 2024 fiscal year, Starbucks China’s revenue in the fourth quarter was $784 million, a year-over-year decline of 7%. Comparable store sales decreased by 14%, with a decline of 8% in average transaction value and a decrease of 6% in order volume.

China is Starbucks‘ largest international market. As of the end of the second quarter of the 2025 fiscal year (end of March 2025), the total number of Starbucks stores in China reached 7,758, covering more than 1,000 county-level markets.

In fact, North America and China are Starbucks’ two most important markets. As of the end of the second quarter, Starbucks stores in the United States and China accounted for 61% of the company’s global portfolio, with 17,122 stores in the U.S. and 7,758 stores in China. Last September, Starbucks appointed Brian Niccol as its new chairman and chief executive officer, whose primary task is to boost the company’s performance.

Meanwhile, the prices at Codi Coffee are even lower. When asked by Jiemian News, Luckin Coffee responded: “We are offering special promotions for the Dragon Boat Festival and Children’s Day, not lowering our prices.”

From www.fooodiee.com